HRStop simplifies the process of generating salary-related documents by allowing you to define formulas for payroll components such as Basic, HRA, Special Allowance, etc. When generating a document using a template, you can enter the CTC value, and the system will automatically calculate all dependent components based on the formulas you’ve set.

This reduces manual errors, saves time, and ensures consistency across all employee letters like Salary Breakup, Offer Letters, and Increment Notices.

Where to Configure CTC-Based Calculations

Navigation Path: Control Panel → Forms and Policies → Document Template

Step-by-Step Guide: Configuring CTC Formulas in a Document Template

Step 1: Edit or Create a Document Template

- Navigate to the Document Template page.

- Locate the template you want to modify or use an existing one.

- Click the Edit icon next to the document template.

Tip: You can also clone an existing template if you want to retain the original and modify a copy.

Step 2: Add Payroll Keys (Fields)

Ensure the following fields (called keys) are included in the document template:

CTC-

Basic -

HRA -

Special_Allowance

(You can include any additional components like PF, Bonus, LTA, etc., depending on your structure.)

These keys act as placeholders in the document and are populated either from the employee profile or via formulas.

Step 3: Assign Formulas to Keys

For each component, you can define a formula so the system calculates it based on the entered CTC value.

Sample Formula Setup:

| Component | Formula |

|---|---|

| Basic | CTC * 0.50 |

| HRA | Basic * 0.40 |

| Special Allowance | CTC - (Basic + HRA) |

How to Add the Formulas:

- Click the Edit icon next to the key in the template field list.

- Enter the desired formula using available keys and mathematical operators.

- Click Save to apply the formula for that field.

You can use +, -, *, /, () , and other basic arithmetic functions.

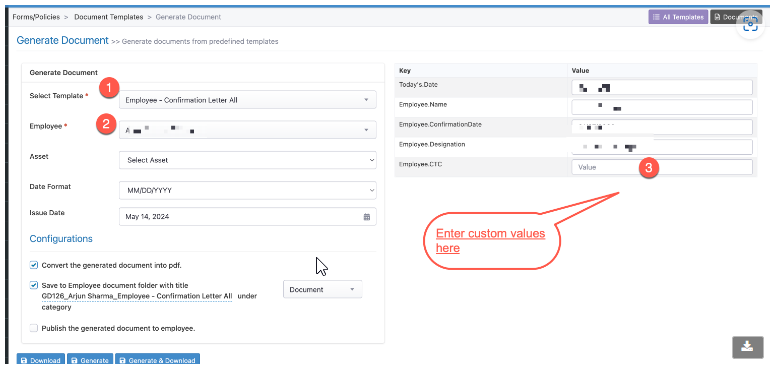

Step 4: Generate the Letter Using Base CTC ( Refer to image above)

Once your template has formulas configured:

- Go to the Bulk Generate or Generate Document screen.

- Select the employee(s) for whom the letter is to be created.

- Click Populate to auto-fill values.

- Manually enter the base CTC (e.g., ₹5,00,000 or ₹3,50,000) in the CTC field.

The system will:

- Automatically calculate Basic, HRA, Special Allowance, etc.

- Populate these fields in the document using your pre-defined formulas.

Step 5: Review, Finalize & Generate the Document

- Review all calculated values for correctness.

- Optionally click on Import Key Values if you need to adjust the auto-filled component values using a CSV.

- Enter the Document Title and Category.

- Choose whether to Publish to employee profiles and/or enable Password Protection.

- Click Generate and Save.

The document will now be created with auto-calculated payroll breakup and saved under the selected employees’ profiles.

Key Notes & Best Practices

- Maintain consistency: Use uniform formulas across all templates to avoid discrepancies in letters for employees in similar roles or pay bands.

- Test with 1–2 employees first before performing bulk generation.

- Use Imort Key Values for edge cases where a component value needs to be overridden for a specific employee.

- Enable password protection for sensitive documents like salary or CTC breakups.

Example: Salary Structure Breakdown Based on ₹6,00,000 CTC

| Component | Formula | Value |

|---|---|---|

| CTC | Input | ₹6,00,000 |

| Basic | CTC * 0.50 | ₹3,00,000 |

| HRA | Basic * 0.40 | ₹1,20,000 |

| Special Allowance | CTC - (Basic + HRA) | ₹1,80,000 |